From July 2012 to August 2014, we filed and received responses from the SEC on 32 separate Freedom of Information Act (FOIA) requests seeking records on the top 10 US banks (as ranked by total assets). We were stunned to learn three of the top 10 US banks have/had exposure to an estimated 40-60 SEC matters each. Worse, these numbers increased dramatically in 2013 for two of them.

In 14 years of having literally filed thousands of FOIA requests with the SEC, we have never seen this much SEC investigative activity related to one single company, or concentrated in one sector. To our experience, the sheer volume of SEC investigative activity we found among the top ten banks simply boggles the imagination.

Before those inclined to rollout the over-used "SEC's investigating everyone" canard get going, we offer this one point in sharp rebuttal: the SEC is not, and has not been, investigating all the banks. We found some top ten banks with no indications of recent SEC investigative activity at all - none.

The balance of this report includes data and analysis on the following --

- Three Top 10 US Banks with Unusually High Levels of SEC Investigative Activity (40-60 Matters Each)

- Top 10 Banks with Little to No Signs of SEC Investigative Activity Since 2012

- Banks in the Top 10 with Undisclosed SEC Investigations

- The Lasting Problem Caused by Poor Disclosure Practices Among Banks

- FOIA Responses Received on Top Ten Banks 2012-2014

- Summary of Disclosures Made by Top Ten Banks

While imperfect, these data do at least provide some sense of where the SEC’s been directing its firepower.

Three Top 10 US Banks With Unusually High Levels of SEC Investigative Activity

(in alphabetical order)

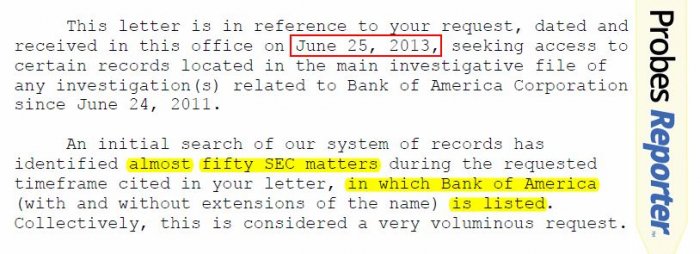

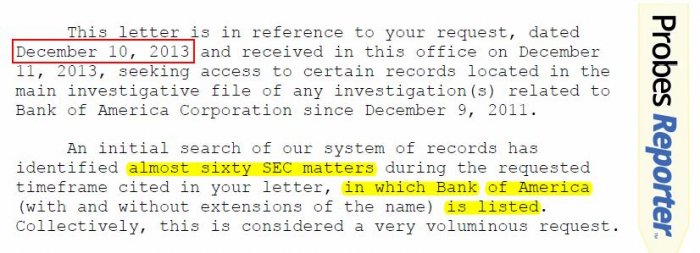

- Bank of America (BAC) We filed FOIA requests on BAC three times since Sep-2012. BAC was listed in almost 50 SEC matters in Jul-2013. That climbed by ten, to almost 60 by year-end, Dec-2013. BAC has made specific reference to SEC investigative activity in its respective filings. See Exhibit A, below.

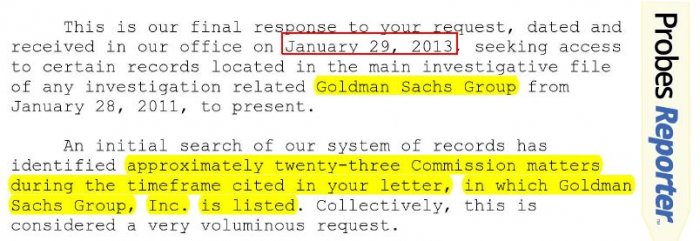

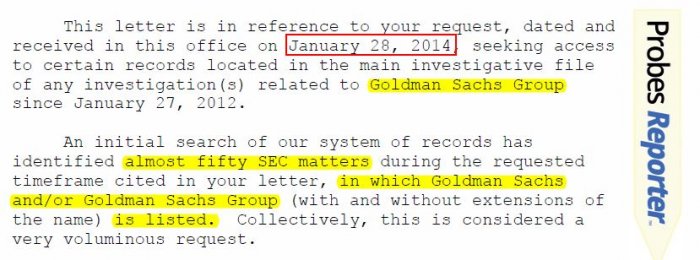

- Goldman Sachs (GS) We filed two FOIA requests on GS since Jan-2013. GS was listed in approximately 23 matters at Feb-2013. This more than doubled over the next year, to almost 50 SEC matters by the end of Jan-2014. Goldman Sachs did not directly disclose the presence of any SEC activity in the latest 10-K filed on 28-Feb-2014. GS made what we call “Generalized disclosures of regulatory activity and/or investigations.” See Exhibit A, below.

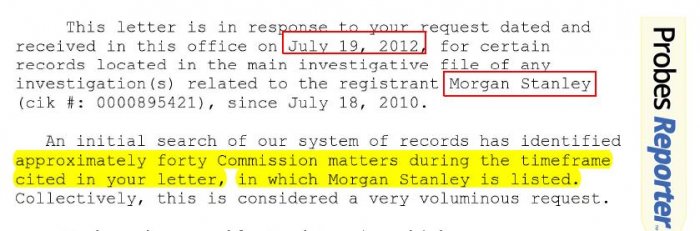

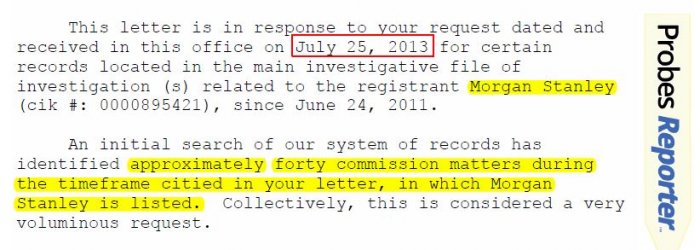

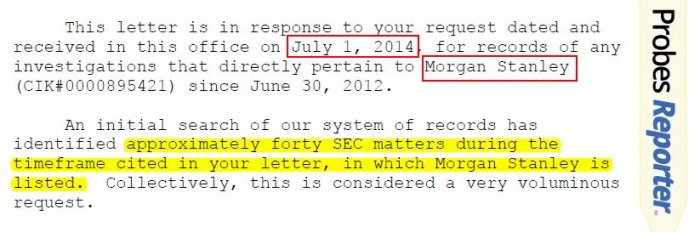

- Morgan Stanley (MS) We’ve researched MS three times since Jul-2012. In each of these three times, the SEC came back and said MS was listed in approximately 40 SEC matters. We were first told that in Sep-2012. The most recent response giving the same data was Jul-2014. MS has made specific reference to SEC investigative activity in its respective filings. See Exhibit A, below.

We know of only one other company where the SEC indicated a high number of SEC matters. That company is outside the banking sector and the number of SEC matters is estimated at 20. A report will be forthcoming on that company soon.

Based on these data, it now appears without merit to claim the SEC has been asleep at the switch or otherwise unresponsive to the harm caused the global economy by major banks. At least when it comes to SEC activity involving BAC, GS, and MS it appears the agency's been especially active.

Bank of America

|

SEC Response Date |

Findings |

|

07-Nov-2012 |

The SEC cites the "law enforcement exemption" of the FOIA as basis to deny the public access to the detailed records we sought on this company. |

|

03-Jul-2013 |

“… almost fifty SEC matters …” |

|

17-Dec-2013 |

“… almost sixty SEC matters …” |

===================================

Goldman Sachs

|

SEC Response Date |

Findings |

|

4-Feb-2013 |

“… approximately twenty-three Commission matters …” |

|

30-Jan-2014 |

“… almost fifty SEC matters …” |

===================================

Morgan Stanley

|

SEC Response Date |

Findings |

|

24-Sep-2012 |

“… approximately forty Commission matters …” |

|

29-Jul-2013 |

“… approximately forty [c]ommission matters …” |

|

16-Jul-2014 |

“… approximately forty SEC matters …” |

===================================

===================================

Top 10 Banks With Little to No Signs of SEC Investigative Activity Since 2012

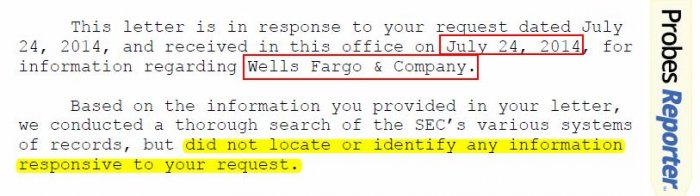

- Wells Fargo (WFC) We found no signs of SEC investigative activity at Wells Fargo in the three FOIA requests we filed since Aug-2012 through our most recent response received Jul-2014.

- US Bancorp (USB) Two investigations a few years back but nothing has been indicated since Jul-2013 through our most recent response received Jul-2014.

- Capital One (COF) It appears Capital One had at least one SEC investigations between Oct-2012 and Feb-2014. They were resolved by May-2014.

- American Express* (AXP) We found no recent signs of SEC investigative activity in the three FOIA requests we filed since Aug-2012 through our most recent response received Aug-2014.

* Though not a top ten bank, we thought it helpful to include American Express in this analysis.

Banks in the Top Ten With Undisclosed SEC Investigations

- Goldman Sachs (GS)

- Bank of New York Mellon (BK)

- PNC Financial Services (PNC)

All three have/had undisclosed SEC investigations this year. All three made what we call “Generalized disclosures of regulatory activity and/or investigations.” See Exhibit A, below.

The Lasting Problem Caused by Poor Disclosure Practices Among Banks

When analyzing regulatory and investigative activity at banks, we routinely encountered sweeping and generalized disclosures in place of the detail needed to analyze the underlying risk that prompted the disclosures in the first place. These practices, when deployed, render company disclosures - in any sector - analytically worthless. This contributes to complacency which can come back to haunt investors later when surprises arise, stocks fall. These practices are not going to go away so long as investors and the SEC tolerate the behavior.

This is a good time to point out that the SEC also refuses to release reports that would let the public know what took place in its closed investigations. We believe that doing so violates the FOIA. Were the SEC to start releasing those reports it prepares at the time investigations end, investors would learn what prompted the probe, what work was done, and the conclusions reached. Transparency would then be improved.

Unfortunately, with the SEC as their powerful enabler in this regard, public companies can take comfort in knowing no one is likely to "rat them out" anytime soon regarding their SEC investigations. Unfortunately, that suggests the sweeping generalizations are not likely to change any time soon.

Exhibit A, below, gives an overview of what we encountered in reviewing the

Top ten banks disclosures for references to SEC activity.

Exhibit A

|

Bank |

Total Assets |

SEC Activity Disclosures in Most Recent 10-K |

|

JPMorgan Chase |

2,520,336 |

Multiple SEC investigations/activities |

|

Bank of America |

2,170,557 |

Certain SEC investigations concluded; Regulatory agency not identified in other cases |

|

Citigroup |

1,909,715 |

Multiple SEC investigations/activities |

|

Wells Fargo |

1,598,874 |

Generalized disclosures of regulatory activity and/or investigations. |

|

Goldman Sachs |

859,914 |

Generalized disclosures of regulatory activity and/or investigations. |

|

Morgan Stanley |

826,568 |

SEC investigation concluded in Jul-2014; Regulatory agency not identified in other cases. |

|

Bank of New York Mellon |

400,740 |

Generalized disclosures of regulatory activity and/or investigations. |

|

US Bancorp |

389,065 |

Generalized disclosures of regulatory activity and/or investigations. |

|

PNC Financial Services |

327,064 |

Generalized disclosures of regulatory activity and/or investigations. |

|

Capital One |

298,317 |

Generalized disclosures of regulatory activity and/or investigations. |

|

American Express Company |

152,384 |

Generalized disclosures of regulatory activity and/or investigations. |

Source: Company Filings for disclosures, Banks Around the World for asset data.

Our FOIA findings for all ten banks, plus American Express follow –

JPMorgan Chase

|

SEC Response Date |

Findings |

|

23-Jan-2013 |

The SEC cites the "law enforcement exemption" of the FOIA as basis to deny the public access to the detailed records we sought on this company. |

|

25-Jul-2013 |

The SEC cites the "law enforcement exemption" of the FOIA as basis to deny the public access to the detailed records we sought on this company. |

|

8-Aug-2013 |

The SEC cites the "law enforcement exemption" of the FOIA as basis to deny the public access to the detailed records we sought on this company. |

|

4-Feb-2014 |

The SEC cites the "law enforcement exemption" of the FOIA as basis to deny the public access to the detailed records we sought on this company. |

|

8-Aug-2014 |

In response to our administrative appeal, the SEC confirmed an on-going enforcement proceeding for this company. |

Citigroup, Inc.

|

SEC Response Date |

Findings |

|

23-May-2012 |

The SEC cites the "law enforcement exemption" of the FOIA as basis to deny the public access to the detailed records we sought on this company. |

|

10-Sep-2014 |

The SEC cites the "law enforcement exemption" of the FOIA as basis to deny the public access to the detailed records we sought on this company. |

Wells Fargo

|

SEC Response Date |

Findings |

|

12-Sep-2012 |

SEC did not locate any information responsive to our request. |

|

16-Jul-2014 |

SEC did not locate any information responsive to our request. |

|

28-Jul-2014 |

SEC did not locate any information responsive to our request. |

Goldman Sachs

|

SEC Response Date |

Findings |

|

4-Feb-2013 |

“… approximately twenty-three Commission matters …” |

|

30-Jan-2014 |

“… almost fifty SEC matters …” |

Morgan Stanley

|

SEC Response Date |

Findings |

|

24-Sep-2012 |

“… approximately forty Commission matters …” |

|

29-Jul-2013 |

“… approximately forty [c]ommission matters …” |

|

16-Jul-2014 |

“… approximately forty SEC matters …” |

Bank of New York Mellon Corp

|

SEC Response Date |

Findings |

|

13-Nov-2012 |

The SEC cites the "law enforcement exemption" of the FOIA as basis to deny the public access to the detailed records we sought on this company. |

|

13-Nov-2013 |

The SEC cites the "law enforcement exemption" of the FOIA as basis to deny the public access to the detailed records we sought on this company. |

|

12-Mar-2014 |

The SEC cites the "law enforcement exemption" of the FOIA as basis to deny the public access to the detailed records we sought on this company. |

US Bancorp

|

SEC Response Date |

Findings |

|

01-Oct-2012 |

The SEC cites the "law enforcement exemption" of the FOIA as basis to deny the public access to the detailed records we sought on this company. |

|

23-Jan-2013 |

The SEC cites the "law enforcement exemption" of the FOIA as basis to deny the public access to the detailed records we sought on this company. |

|

12-Jul-2013 |

SEC did not locate any information responsive to our request. |

|

07-Nov-2013 |

SEC did not locate any information responsive to our request. |

|

09-Jul-2014 |

SEC denies public access to records on closed investigations involving this company. |

|

30-Jul-2014 |

SEC denies our administrative appeal to have access to records on closed investigations involving this company. In same letter, SEC confirms no formal order of investigation, wells notices, or subpoenas were issued in connection with either investigation noted above. |

PNC Financial Services Group, Inc.

|

SEC Response Date |

Findings |

|

17-Oct-2012 |

SEC did not locate any information responsive to our request. |

|

01-Oct-2013 |

The SEC cites the "law enforcement exemption" of the FOIA as basis to deny the public access to the detailed records we sought on this company. |

|

26-Mar-2014 |

The SEC cites the "law enforcement exemption" of the FOIA as basis to deny the public access to the detailed records we sought on this company. |

|

16-May-2014 |

In response to our administrative appeal, the SEC confirmed an on-going enforcement proceeding for this company. |

Capital One Financial Corp

|

SEC Response Date |

Findings |

|

02-Oct-2013 |

The SEC cites the "law enforcement exemption" of the FOIA as basis to deny the public access to the detailed records we sought on this company. |

|

26-Feb-2014 |

The SEC cites the "law enforcement exemption" of the FOIA as basis to deny the public access to the detailed records we sought on this company. |

|

27-May-2014 |

In response to our administrative appeal, the SEC indicated the investigation was over and the file was remanded for further processing. |

American Express Company

|

SEC Response Date |

Findings |

|

04-Sep-2012 |

SEC did not locate any information responsive to our request. |

|

31-Jul-2013 |

SEC did not locate any information responsive to our request. |

|

26-Aug-2014 |

SEC did not locate any information responsive to our request. |

To learn more on our process and what our findings mean, click here.

Notes: The SEC did not disclose the details on investigations referenced above. The SEC reminds us that its assertion of the law enforcement exemption should not be construed as an indication by the Commission or its staff that any violations of law have occurred with respect to any person, entity, or security. New SEC investigative activity could theoretically begin or end after the date covered by this latest information which would not be reflected here.